One of the basic definitions of cities is that they are places where land becomes increasingly valuable. A square foot of land costs more to own or rent in downtown Boston than it does in, say, rural Maine, and this pattern holds true throughout global patterns of urbanization. In fact, even before the emergence of the industrial city, early economic geographers realized that valuable land near centers of population tends to get put to use for more capital-intensive purposes.

Boston is one of the most expensive cities in one of the most expensive countries on earth, which means that land in Boston represents some of the most costly plots of dirt anywhere on the globe. (In 2018, a research firm found that just a single parking space in downtown Boston could fetch $350,000.) What’s especially interesting about Boston’s high-value land, though, in comparison to other expensive cities, is the fact that much of it wasn’t always land. Many parts of Boston—including some of what are today its most expensive neighborhoods—were created over the past 300 years.

This 1895 map documents the changing shoreline of Boston using different colors

No city in the U.S. has a more striking history of landmaking than Boston, with about a sixth of its present land area sitting on estuaries, mudflats, coves, and tidal basins that would have been submerged at high tide prior to the seventeenth century. Mapping the growth of the city into the surrounding ocean has been an interest of Boston’s geographers for centuries , and our modern maps of shoreline change are some of the most popular objects in our digital collections.

This 1852 plan shows the Back Bay area just before its most dramatic period of land filling

The value of urban land and the processes of urban landmaking were more than just coincidentally related to one another. Bostonians created land out of water because it was lucrative: with a historic core tightly hemmed in on the Shawmut peninsula, Boston faced severe geographical constraints on where its growing population could be housed and where new industrial and commercial facilities could be built. The proximity of shallow water in places like the Back Bay, immediately adjacent to downtown, yielded a straightforward economic calculation. Chewing up hills and quarries throughout the region and spitting them out in the water around Boston wasn’t cheap, and it certainly wasn’t easy for the thousands of laborers who were employed shoveling, dumping, and grading. But for the investors who backed such projects, the profit was obvious. They were creating the ultimate financial asset: brand-new urban land, ready for development.

Today, even though trains and highways have made it possible for Boston to expand its urban footprint far inland, some of the city’s most valuable neighborhoods are still located near to center, in places like the Back Bay, the Seaport, and South Bay that were created by fill projects. (Economists regularly point to the “agglomeration effects” that make clustering together in cities a valuable phenomenon.) The legacy of landmaking coupled with the continued financial value of urban space means that a huge amount of Boston’s wealth—as well as the tax revenue that’s generated from property assessment—rests literally on invented property. All of that prompts the question: how much, in dollar terms, is all of that made land worth today?

That’s an interesting question to try to answer using the tools of historic GIS. We have a new geospatial data set, created originally for the book Mapping Boston, that traces the border between land and water at various points since 1630. (When we release the first version of our public data portal later this year, you’ll be able to access it online. For now, if you want a copy of this data, make a GIS reference request.) And the City of Boston has public open data on tax parcels and their assessed value.

This interactive Python notebook shows how we ran this GIS analysis

There are nearly 100,000 tax parcels in the City’s data set. For each of these, we can run a spatial comparison to see if they would have fallen inside or outside of the city’s shoreline in 1630 (or if they would have overlapped it, with some of the present-day parcel falling on land and some on water). That’s a fairly straightforward geospatial calculation, but running it on tens of thousands of records takes some computing time. We’ve made a Python script to process all of that data and uploaded it to Kaggle; you can try running it yourself in the browser, or downloading it to run on your own computer.

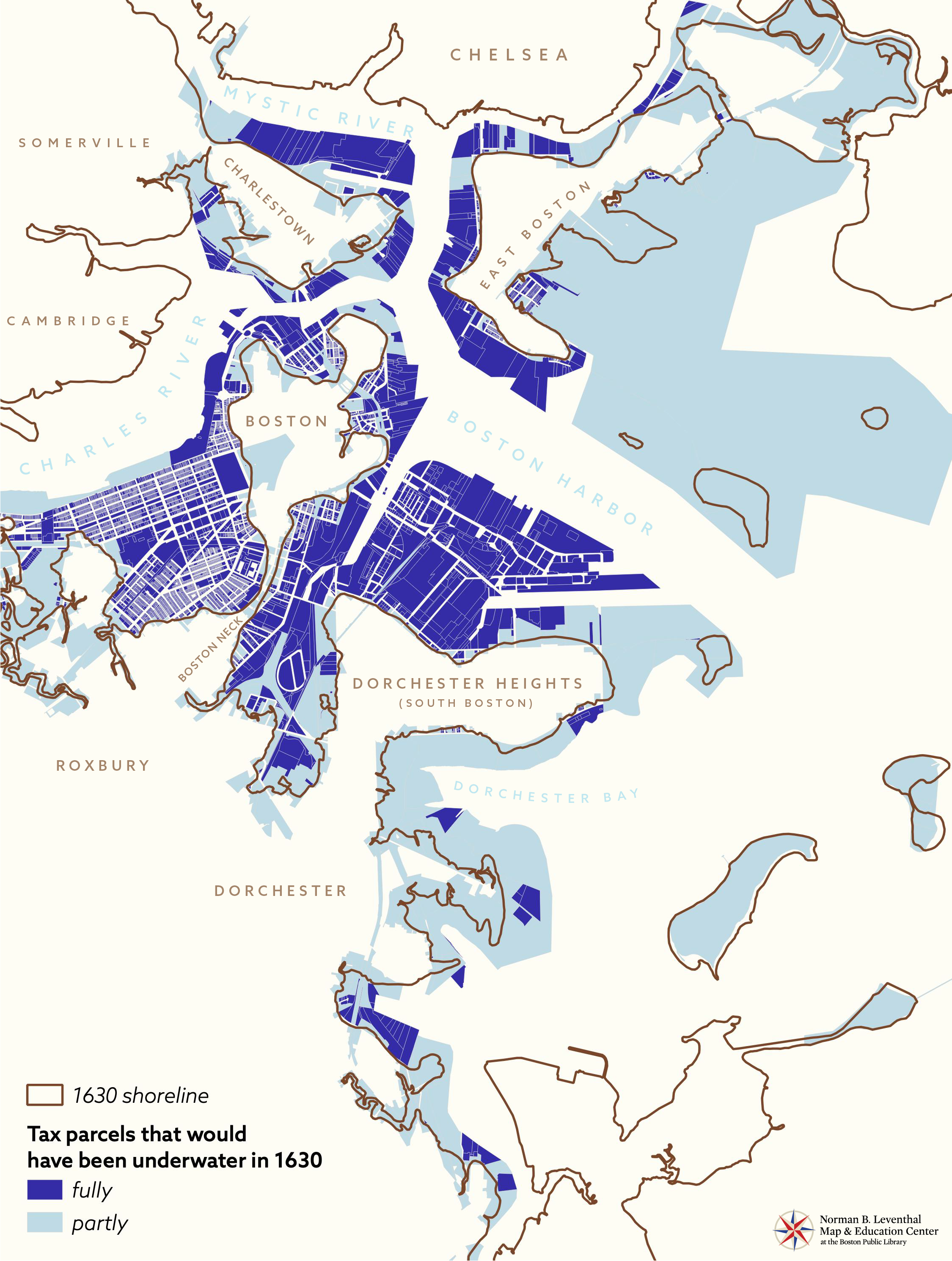

That gives us a map like this one. Here, you see the 1630 outline of Boston’s land compared with parcels from 2020. All of the parcels that are shaded deep blue would have been entirely underwater before Boston’s modern landmaking began. All of the light-blue parcels would have been at least partly underwater. (Many of these latter parcels are large publicly-owned pieces of land, like Logan Airport.)

How much are all of these parcels worth? We can merge the information about formerly-underwater parcels to tax assessment data to find that number. The result is pretty jaw-dropping: more than $36 billion of assessed property in Boston lies entirely on land that was part of the ocean 400 years ago! If we include all of the parcels that lie partly on made land, it adds another $18 billion worth of assessed value, for a total of more than $54 billion.

The reason the City keeps scrupulous data about assessed value is because it draws much of its revenue from property taxes on land. So how much tax does the City raise from these “underwater properties”? In 2020, more than $650 million in municipal tax bills were levied on properties lying entirely or partly on made land. That’s more than a quarter of the City’s entire property tax assessment! And property taxes make up about 70% of the City’s revenue, which means just under a fifth of the City’s total revenue comes from taxes on made land.

This 1873 plan shows how much of Cambridge and Somerville also lies on fill, though the tax parcels of these cities weren’t included in this analysis

That number is almost certainly an undercount, too. The historic shoreline data doesn’t go all the way up the Charles River into Allston and Brighton, so we’re not including any tax parcels that are outside of the area for which we have shoreline information. And we’re only counting the City of Boston, here, not Somerville, Cambridge, Chelsea, or other municipalities that rest partly on made land. Furthermore, most public land isn’t taxed; for instance, the Public Garden, which sits on 24 acres of filled land, doesn’t raise any property taxes for the city.

All of this should raise some interesting questions about where, exactly, property comes from. When you buy a piece of real estate, the attorney closing the sale will conduct a title search. This involves following the ownership history of the piece of property in question back into the past, to ensure that whoever is selling it to you really does own it, that whoever previously sold it to them also owned it, and so on. But if you follow the title history all the way back, where does it begin? In other words, what are the origins of property?

This is a question which philosophers, political theorists, and economists have long debated. The case of made land is one example where we can trace back to historically examine how something unowned (the common property of the tidal flats) is converted, by a process of both physical transformation and socio-legal justification, into something which can be privately owned and attached to a dollar value in a financial system. But that process also took place over and over again in North America even when land wasn’t being literally created, since the entire basis of European settlement rested on the confection of private property where it had not previously existed—a process made possibly by both legal alchemy as well as the outright expropriation and removal of Native peoples. (See, for example, Margaret Pearce’s essay “Witnesses” in our America Transformed catalog for more on this topic.)

In our Land Acknowledgement, we note that the Back Bay neighborhood on which the BPL stands was once a water-based ecosystem inhabited by the Massachusett people. Sophisticated networks of fish weirs can still be found buried beneath the streets of the neighborhood, which were laid out in a tidily gridded pattern in the nineteenth century to facilitate the engrossment and sale of property. In such a fashion, the economic value of fish coming in and out with the tide was dramatically supplanted by a totally different value system, one which now accounts for billions of dollars on modern accounting books.

Our articles are always free

You’ll never hit a paywall or be asked to subscribe to read our free articles. No matter who you are, our articles are free to read—in class, at home, on the train, or wherever you like. In fact, you can even reuse them under a Creative Commons CC BY-ND 2.0 license.